Understanding Health Insurance

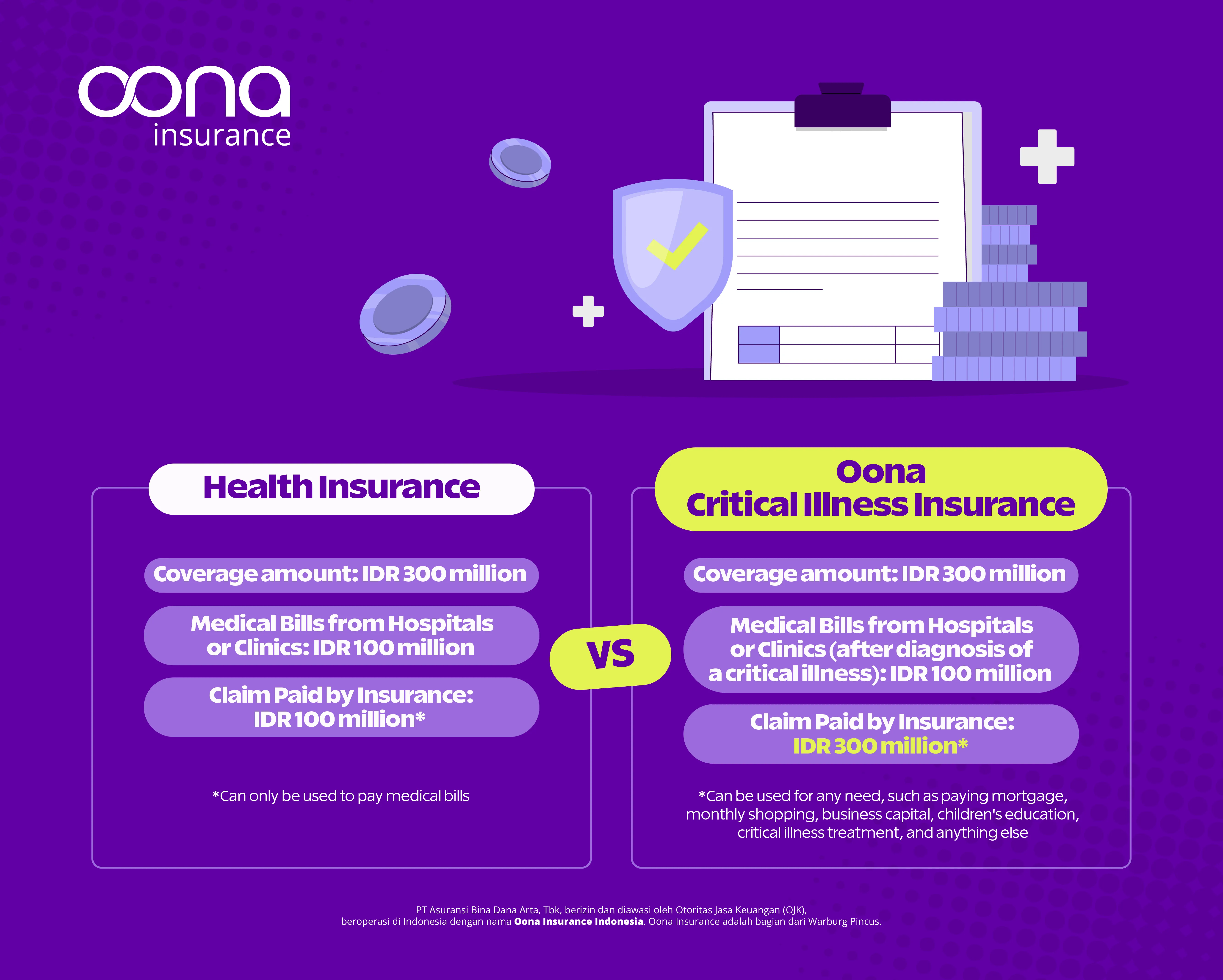

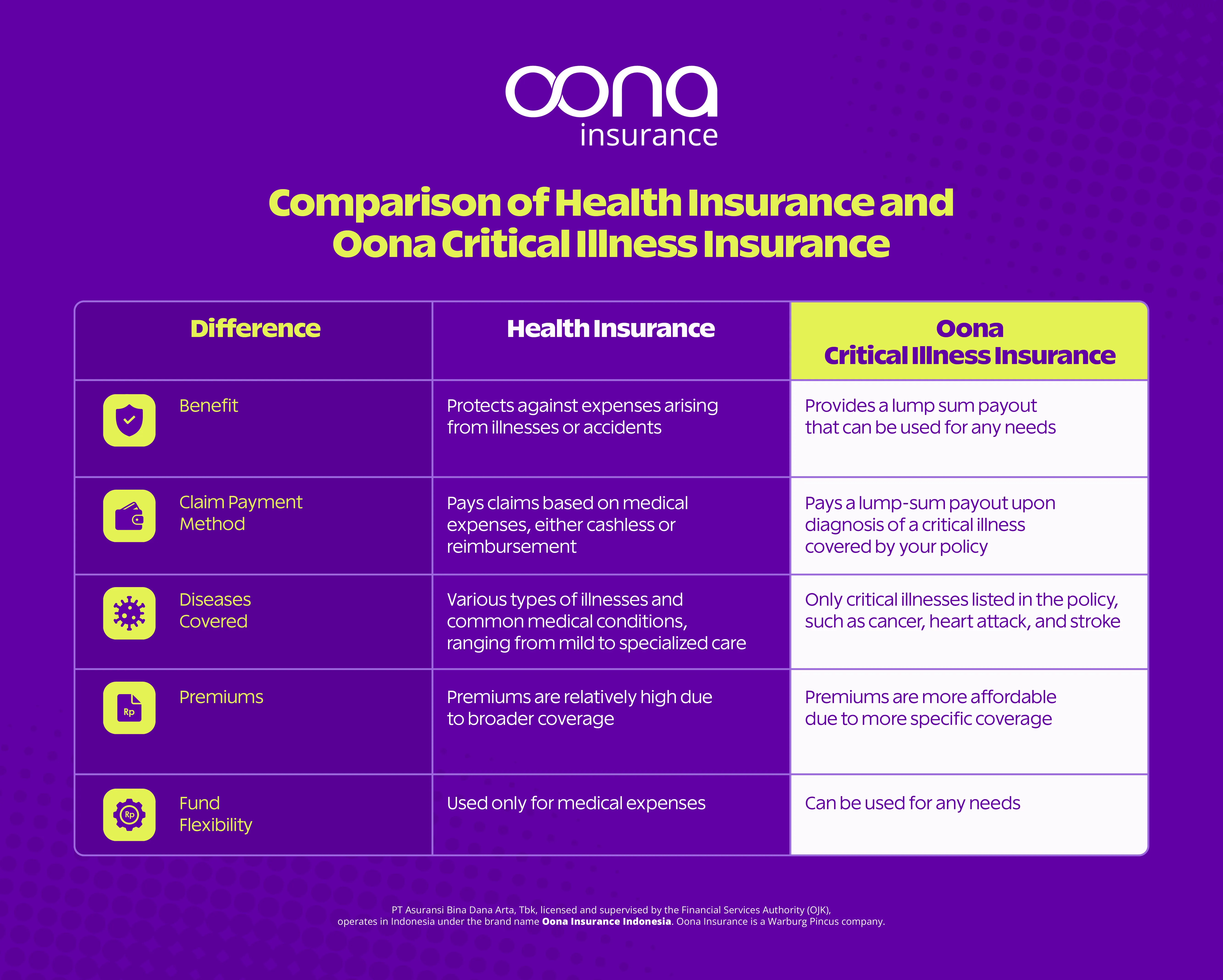

Health insurance provides financial protection by reimbursing medical expenses for policyholders facing health issues. It covers various medical costs such as hospital stays, doctor consultations, medications, and other medical procedures. For example, if you have health insurance and need surgery, your insurance company will cover part or all of the surgery costs, depending on your policy terms.

Health insurance typically includes coverage for common illnesses, accidents, and even preventive care like vaccinations and routine check-ups.

For critical illness, you can claim concurrently with health insurance

Understanding Critical Illness Insurance

Critical illness insurance provides financial benefits if the policyholder is diagnosed with a listed critical illness. These usually include serious conditions like cancer, heart attack, and stroke. For instance, if you have critical illness insurance and are diagnosed with cancer, you will receive a lump sum payment that can be used for various needs like debt repayment or daily living expenses.

Benefits of Oona Critical Illness Insurance

- Lump Sum Payment: Provides a one-time payment after a critical illness diagnosis.

- Flexible Use of Funds: The received money can be used for any purpose.

- Additional Protection: Offers an extra layer of protection not provided by standard health insurance.